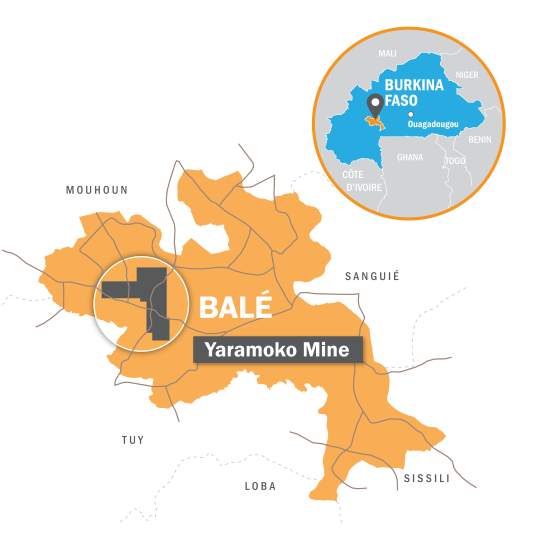

Our Yaramoko Mine is in the Houndé greenstone belt region in the Province of Balé in southwestern Burkina Faso. In 2023, Yaramoko produced 117,711 ounces of gold.

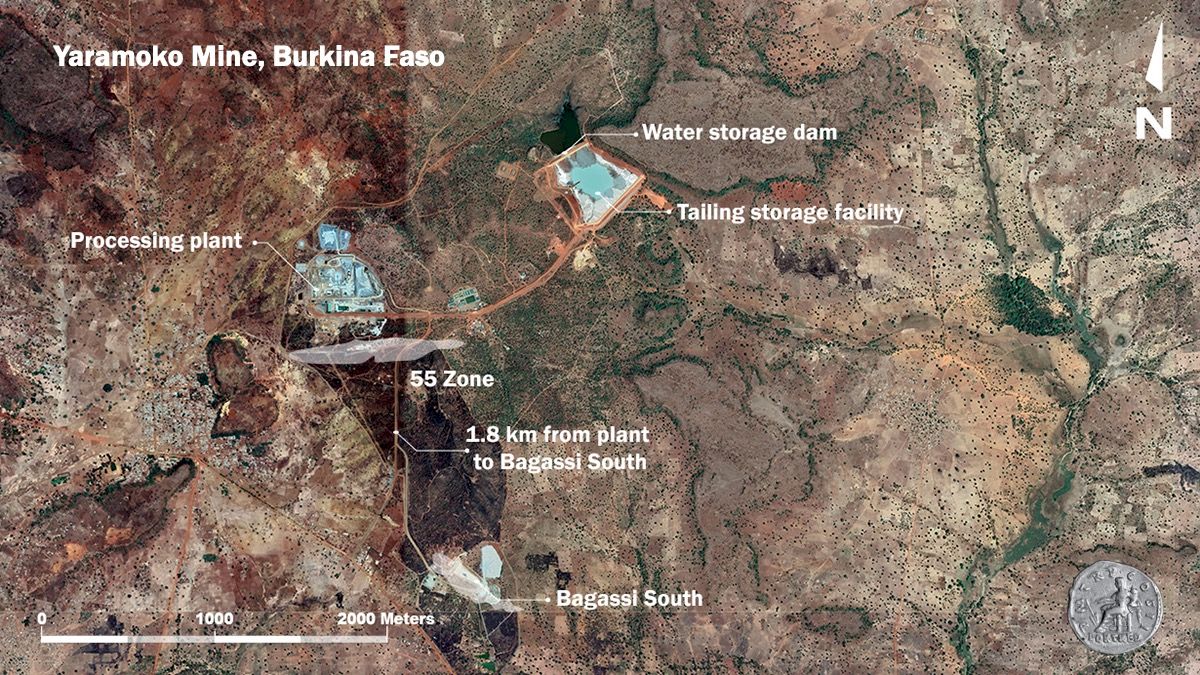

The Yaramoko Mine consists of two underground gold mines: the 55 Zone and Bagassi South. The deposits are greenstone-hosted high-grade orogenic gold deposits. The Bagassi South Zone deposit is located 1.8 kilometers south of 55 Zone and the surface definition of the veins can be traced over a strike length of 800 meters and dips to the northeast. Gold typically occurs as coarse free grains in quartz and is associated with pyrite.

Based on reserves reported as of December 31, 2023 the operation has a mine life of two years.

We recognize the role that the Yaramoko Mine plays to support sustainable development in our areas of influence around the mine. In 2023, we employed 896 direct employees and contractors.

Yaramoko Mine Video

with cemented

rock fill

OPERATING HIGHLIGHTS

| 20231 |

2024E1 |

|

|---|---|---|

|

Tonnes milled (000) |

532 |

435 |

|

Gold production (koz) |

117.7 |

105 - 119 |

|

AISC2,3,4 (US$/oz Au) |

$1,499 |

$1,220 - $1,320 |

Notes:

- Refer to Fortuna news releases dated January 18, 2023, "Fortuna reports record 2023 production of 452 koz Au Eq and 2024 annual guidance of 457 to 497 koz Au Eq"

- Cash Cost and all-in sustaining cost (AISC) are non-IFRS financial measures which are not standardized financial measures under the financial reporting framework used to prepare the financial statements of the Company and might not be comparable to similar financial measures disclosed by other issuers. Refer to the note under “Non-IFRS Financial Measures” on this website.

- The following table provides the historical cash costs and historical AISC for the four operating mines for the year ended December 31, 2022, as follows:

Mine Cash Costa,b,c AISCa,b,c SILVER ($/oz AgEq) ($/oz AgEq) San Jose, Mexico 10.56 15.11 Caylloma, Peru 12.34 17.97 GOLD ($/oz Au) ($/oz Au) Lindero, Argentina 740 1,142 Yaramoko, Burkina Faso 840 1,529 - (a) Cash cost and AISC are non-IFRS financial measures; refer to the note under “Non-IFRS Financial Measures” on this website.

- (b) Silver equivalent was calculated at metal prices of $1,802/oz Au, $21.75/oz Ag, $2,161/t Pb and $3,468/t Zn for the year ended December 31, 2022

- (c) Further details on the cash costs and AISC for the year ended December 31, 2022 are disclosed on pages 38, 40, and 41 (with respect to cash costs) and pages 39 and 42 (with respect to AISC) of the Company’s management discussion and analysis (“MD&A”) for the year ended December 31, 2022 dated as of March 15, 2023 (“2022 MD&A”) which is available under Fortuna's SEDAR+ profile at www.sedarplus.ca and is incorporated by reference into this news release, and the note under “Non-IFRS Financial Measures” on this website.

- Cash cost includes production cash cost. AISC includes sustaining capital expenditures, worker’s participation (as applicable) commercial and government royalties mining tax, export duties (as applicable), subsidiary G&A and Brownfields exploration and is estimated at metal prices of $1,800/oz Au, $22/oz Ag, $2,000/t Pb, and $2,500/t Zn. AISC excludes government mining royalty recognized as income tax within the scope of IAS-12.

LOCATION

The Yaramoko Mine is situated in the Houndé greenstone belt region in the Province of Balé in southwestern Burkina Faso. The property is located approximately 200 kilometers southwest from the capital city of Ouagadougou (Latitude: 11° 45’ 25” N, Longitude: 3° 16’ 58” W).

Our operations add value to Burkina Faso’s formal economy by providing contracts and stable jobs for local people and by helping to expand the revenue base of our host government through income taxation, national social security system contributions and the royalties we pay every time we ship gold.

GEOLOGY AND MINERALIZATION

The north-northeast-trending Boni shear zone divides the Yaramoko concession between the predominantly Houndé volcanic and volcaniclastic rock to the west and the Diébougou granitoid domain composed predominantly of granitic rock with minor volcanic rock to the east. The main lithological units are mafic volcanic rocks, felsic intrusions, and late dolerite dikes.

This region is considered prospective for orogenic gold deposits, which typically exhibit a strong relationship with regional arrays of major shear zones. The largest granitic intrusion found on the Yaramoko concession is host to both the 55 Zone and Bagassi South Zone gold deposits. Both deposits are set on the eastern margin of the intrusive in the footwall of the Yaramoko shear along conjugated dextral faults located in extensional position to the regional shear zone. The bulk of the gold mineralization occurs in dilatational segments of the shear zones where quartz veins are thicker and exhibit greater continuity.

MINERAL RESERVES

0.9 million tonnes

averaging 7.9 g/t Au containing 0.2 Moz Au

Refer to Mineral Reserves and Resources table below for full disclosure

BROWNFIELDS EXPLORATION

The Brownfields exploration program budget for 2024 at Yaramoko is $6.1 million, which includes 41,450 meters of exploration drilling, with underground drilling testing western and depth extensions to the Zone 55 deposit, surface drilling testing several anomalies along the Boni Shear, Bagassi South surface extensions, and other surface targets.

Mineral Reserves and Resources

|

Mineral Reserves - Proven and Probable |

Contained Metal |

|||

|---|---|---|---|---|

|

Property |

Classification |

Tonnes (000) |

Au (g/t) |

Au (koz) |

|

55 Zone Underground |

Proven |

0 |

||

|

Probable |

509 |

9.56 |

157 |

|

|

Proven + Probable |

509 |

9.56 |

157 |

|

|

55 Zone Open Pit |

Proven |

|||

|

Probable |

83 |

6.44 |

17 |

|

|

Proven + Probable |

83 |

6.44 |

17 |

|

|

109 Zone Open Pit |

Proven |

|||

|

Probable |

120 |

2.04 |

8 |

|

|

Proven + Probable |

120 |

2.04 |

8 |

|

|

Bagassi South QV Prime Underground |

Proven |

|||

|

Probable |

120 |

8.44 |

33 | |

|

Proven + Probable |

120 | 8.44 | 33 | |

|

Bagassi South Underground |

Proven |

|||

|

Probable |

10 |

4.44 | 1 | |

|

Proven + Probable |

10 | 4.44 | 1 | |

|

Stockpiles |

Proven |

21 |

5.44 | 4 |

|

Probable |

0 | |||

|

Proven + Probable |

21 | 5.44 | 4 | |

|

Combined |

Proven |

21 |

5.44 | 4 |

|

Probable |

842 | 7.96 | 216 | |

|

Proven + Probable |

863 |

7.90 | 219 | |

|

Mineral Resources - Measured and Indicated |

Contained Metal |

|||

|---|---|---|---|---|

|

Property |

Classification |

Tonnes (000) |

Au (g/t) |

Au (koz) |

|

Z55 Underground |

Measured |

18 |

4.33 | 2 |

|

Indicated |

225 | 3.30 | 24 | |

|

Measured + Indicated |

243 | 3.38 | 26 | |

|

Z55 Open Pit |

Measured |

0.00 | ||

|

Indicated |

54 |

3.67 | 6 | |

|

Measured + Indicated |

54 | 3.67 | 6 | |

|

Z109 Open Pit |

Measured |

0.00 | ||

|

Indicated |

102 | 1.34 | 4 | |

|

Measured + Indicated |

102 | 1.34 | 4 | |

|

Bagassi South QV Prime Underground |

Measured |

0.00 | ||

|

Indicated |

63 | 2.80 | 6 | |

|

Measured + Indicated |

63 | 2.80 | 6 | |

|

Bagassi South Underground |

Measured |

0.00 | ||

|

Indicated |

8 |

2.21 | 1 | |

|

Measured + Indicated |

8 | 2.21 | 1 | |

|

Combined |

Measured |

18 |

4.33 | 2 |

|

Indicated |

452 | 2.82 | 41 | |

|

Measured + Indicated |

469 |

2.87 |

43 |

|

|

Mineral Resources - Inferred |

Contained Metal |

|||

|---|---|---|---|---|

|

Property |

Classification |

Tonnes (000) |

Au (g/t) |

Au (koz) |

|

Z55 Underground |

Inferred |

53 |

3.02 |

5 |

|

Z55 Open Pit |

Inferred |

21 |

4.03 |

3 |

|

Z109 Open Pit |

Inferred |

5 | 1.02 | 0 |

|

Bagassi South QV Prime Underground |

Inferred |

56 | 3.56 | 6 |

|

Bagassi South Underground |

Inferred |

24 | 4.63 | 4 |

|

Combined |

Inferred |

159 |

3.52 | 18 |

-

Notes:

- Mineral Reserves and Mineral Resources are as defined by the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves

- Mineral Resources are exclusive of Mineral Reserves

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability

- Factors that could materially affect the reported Mineral Resources or Mineral Reserves include; changes in metal price and exchange rate assumptions; changes in local interpretations of mineralization; changes to assumed metallurgical recoveries, mining dilution and recovery; and assumptions as to the continued ability to access the site, retain mineral and surface rights titles, maintain environmental and other regulatory permits, and maintain the social license to operate

- Mineral Resources and Reserves for the Yaramoko Mine are reported as of December 31, 2023

- Mineral Reserves for Yaramoko are reported at a cut-off grade of 1.57 g/t Au for the 55 Zone open pit, 0.86 g/t Au for the 109 Zone open pit, 4.5 g/t Au for 55 Zone underground, 3.8 g/t Au for Bagassi South QVP and QV underground based on an assumed gold price of US$1,600/oz, metallurgical recovery rates of 96.8%, underground mining costs of US$154/t, processing cost of US$28/t and G&A costs of US$27/t, surface mining costs of US$4.95/t, processing cost of US$27/t and G&A costs of US$33/t. Underground average mining recovery is estimated at 90% for Bagassi South QV and QVP, 93% for 55 Zone SLS stopes and 86% for SPS (sill drifts) stopes. A mining dilution factor of 10% has been applied for sill drifts, 0.7m and 0.4m dilution skin has been applied for SLS and shrinkage mining respectively. Surface mining recovery is estimated to average 100% and mining dilution 0% having been accounted for during block regularization to 5m x 5m x 5m size within an optimized pit shell and only Proven and Probable categories reported within the final pit designs. Yaramoko Mineral Resources are reported at a gold grade cut-off grade of 0.9 g/t Au for the 55 Zone open pit, 0.5 g/t Au for the 109 Zone open pit, and 2.7 g/t Au and 2.5 g/t Au for underground 55 Zone and Bagassi South respectively, based on an assumed gold price of US$1,840/oz and the same costs, metallurgical recovery and constrained within an optimised pit shell. The Yaramoko Mine is subject to a 10% carried interest held by the government of Burkina Faso.

- Eric Chapman is the Qualified Person responsible for Mineral Resources and Raul Espinoza is the Qualified Person responsible for Mineral Reserves both being an employee of Fortuna Silver Mines Inc.

- Totals may not add due to rounding procedures

Photo Gallery

Corporate Video - A global intermediate gold and silver producer